It is an organization or volunteer group promoting social welfare and the improvement of society. NGOs are private agencies that can support development at the local, national, and international levels by organizing indigenous groups. NGOs as citizen groups raise awareness and influence policies and include independent cooperatives, community associations, societies, groups, and various other associations. NGOs work for the improvement and upliftment of socio-economically and politically weaker sections of the community to improve their status in society and develop their way of living and existence so that they can have equal rights and opportunities. As a community group and organization, an NGO provides and fulfills certain services, development-oriented tasks. The organization works with the aims and objectives to bring about necessary positive changes in society, community, areas, and situations. An NGO is managed by resources, funds, and other kinds of desirable support from the Government, funding agencies, support agencies, support communities, and with the help and support of business groups and people. NGO as charitable and religious associations manage private funds for development, distribution of food, clothes, medicines, equipment, facilities, and other tools to underprivileged people and communities.

NGOs or similar organizations exist in all parts of the world. An NGO in one country might not qualify as an NGO in another, as permitted activities, legal definitions, monitoring, and oversight differ from country to country. The term can contain many types of organizations. If you desire to serve society and help the people, the best way to achieve this goal is by going for NGO registration. Determine the agenda of the NGO, then go ahead with NGO registration.

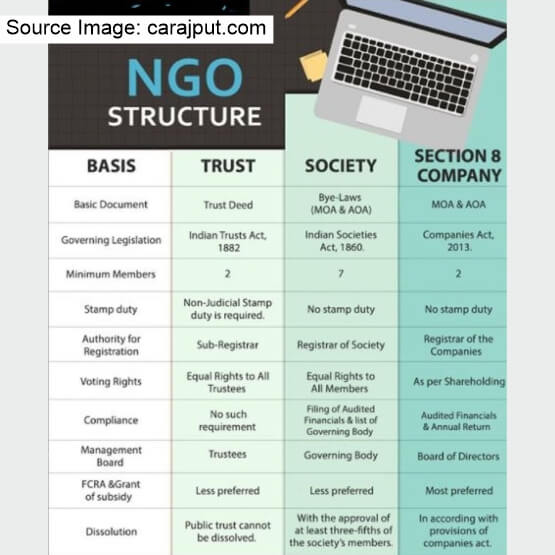

TYPES OF REGISTRATIONS FORMED UNDER INDIAN ACTS FOR NGOs

TRUST (Indian Trusts Act, 1882)

Public charitable trusts are usually formed when the land or property is involved. The Public Charitable Trust is a possible form of NGO entity in India. The registration for trust can be done through the Indian Trusts Act, 1882. Indian public trusts generally cannot be changed. No national law governs public charitable trusts in India, although many states (particularly Maharashtra, Gujarat, Rajasthan, and Madhya Pradesh) have Public Trust Acts. Trusts may be established for the following purposes:- Relief of poverty or distress;

- Education;

- Medical relief;

- Provision of facilities for recreation or other leisure-time occupations (including assistance for such provision), if the facilities are provided in the interest of social welfare and public benefit; and

- The advancement of any other object of general public utility, excluding purposes that relate exclusively to religious teaching or worship.

Papers mandatory for the Trust registration:

- Aadhar Card

- Driving License

- Passport

- Voter ID

- A bill of water or electricity stating the address that is required to be registered

Advantages of Trust Registration

Trusts get land from the government. If a trust is registered under the Trust Act, it uses a Government registered name. They get Tax benefits, 80G certificate benefits, white money for the construction of the building and they get benefits on service tax or income tax.SOCIETIES (Societies Registration Act 1860)

Another way in which you can register an NGO is in the form of society. Societies are membership organizations that may be registered for a charitable purpose, scientific purpose, and various other objectives. They are usually managed by a governing council or a managing committee. Societies are governed by the Societies Registration Act 1860, which has been adopted by various states. Unlike trusts, societies may be dissolved.According to Section 20 of the Societies Registration Act, the types of societies that may be registered under the Act include, but are not limited to, the following:

- Charitable societies;

- Societies established for the promotion of science, literature, education, or the fine arts; and

- Public art museums and galleries, and certain other types of museums.

Papers mandatory for Society registration:

- Two copies of the Memorandum of Association and by-laws of the society

- Identity proof of nice members

- Aadhar Card

- Voter ID

- Passport

- Driving license

- Address proof of the office- water bill or electricity bill

- Name of the society

Benefits under Society Registration

A registered society gets a separate legal identity. Each member of this society is responsible for their actions and not the other members. Since society NGO is a separate legal identity, the liability of members is limited to their share only. They get benefits on income tax. Societies are provided with legal protection. Nobody can use their name, in case there is an issue as such, they will be large for a penalty.SECTION 8 COMPANIES (Section 8 of the Indian Companies Act, 2013)

The third way to register an NGO is by Section 8 of the Indian Companies Act, 2013. A section 8 company (previously, section 25 company) is a company with limited liability. But the earnings of this company are not used by the shareholders, rather it is used by the company for promotion work. An individual can register the company as a public limited company (requires three directors) and a private limited company (2 directors).Paper mandatory for Section 8 Company registration:

- Memorandum of Association (MOA)

- Articles of Association (AOA)

- Company’s name for approval

- Aadhar Card

- Voter ID

- Copy of passport

- Driving license/ identity proof of all the directors

- Address proof of the office, that is, water bill or electricity bill or tax receipt

Benefits of Section 8 company registration

There is no minimum capital requirement for establishing an NGO as per section 8 company. Similar to the trust, a Section 8 company also gets the special recognition of a separate legal entity. One of the benefits that every NGO reaps is the benefit of tax. Apart from the stakeholders, the contributors to the NGO can also get tax exemption for the donation made to the NGO. NGOs are exempted from stamp duty which is otherwise applicable for the registration process. There is no title requirement. Moreover, section 8 companies are not required to use a suffix to its name, which the public limited or private limited company has to use. When compared with any other NGO structure, a Section 8 company is more credible. The central government does not govern section 8 companies, and hence the MOA and AOA remain unassailable. Thus making its legal structure more trustworthy as compared to society, NGO, or trust. Easy transfer of ownership is something that Section 8 Company enjoys. As per Section 8 of the Income Tax Act of 1961, people can transfer the ownership of both moveable and immobile assets without any restrictions.

TAX LAWS

The income of certain NGOs carrying out specific types of activities is exempt from corporate income tax, with the warning that unrelated business income is subject to tax under certain circumstances. India's tax laws affecting NGOs are similar to the tax laws of other Commonwealth nations. India also subjects sales of certain goods and services to the Goods & Services Tax (GST). Education and healthcare services are exempt under GST. The rates range from 5 percent to 28 percent, with most goods and services taxed at 18 percent. NGOs involved in relief work and in the distribution of relief supplies to the needy are 100 percent exempt from Indian customs duty on the import of items such as food, medicine, clothing, and blankets. Other exemptions may also be available.Registering an NGO is beneficial for an organization to avail the benefits of tax exemption and as well as many benefits upon the registration. A complete list of documents required for NGO registration in India has been mentioned above in the article. The rules and procedure must be followed properly in accordance with the prescribed Act under which an NGO is formed.