India is one of the world’s fastest-growing markets. The country is observing an extensive increase in internet users especially in tier 2 and tier 3 cities, towns, and villages. Increased availability of bandwidth, cheap data plans, and improved awareness is bridging the digital gap between urban and rural India.

India has seen a series of new policy launches since 2014. The Digital India program was one of those critical policies which came our way. It was launched to make India a digitally empowered society. The Demonetisation Policy, implemented in 2016, has led to the rapid adoption of e-wallets, credit cards, and debit cards as a medium of payment. Such digital payments have significantly replaced cash transactions at least in urban areas. The government on its end is pushing and encouraging the Indian public to go cashless and reduce dependence on cash transactions. The purpose is to make us adopt digital payments to curb the use of black money and to avoid the use of fraudulent notes altogether. Digital transactions make us follow a legal path that is helpful to flourish the economy. The use of plastic money gives freedom as well as security to citizens of the country because it works on technical grounds. Digital payments will be helpful to the global world. These mobile payments are building blocks towards societal development while simultaneously reducing environmental pressure.

Impact of Digitisation on Economy

The impact of Digital India on Indian Economy can be observed in many sectors - agriculture, banking, employment creation, online business creation, and many more. It is estimated that India’s digital economy has the potential to become a 1 Trillion USD ecosystem by 2025.

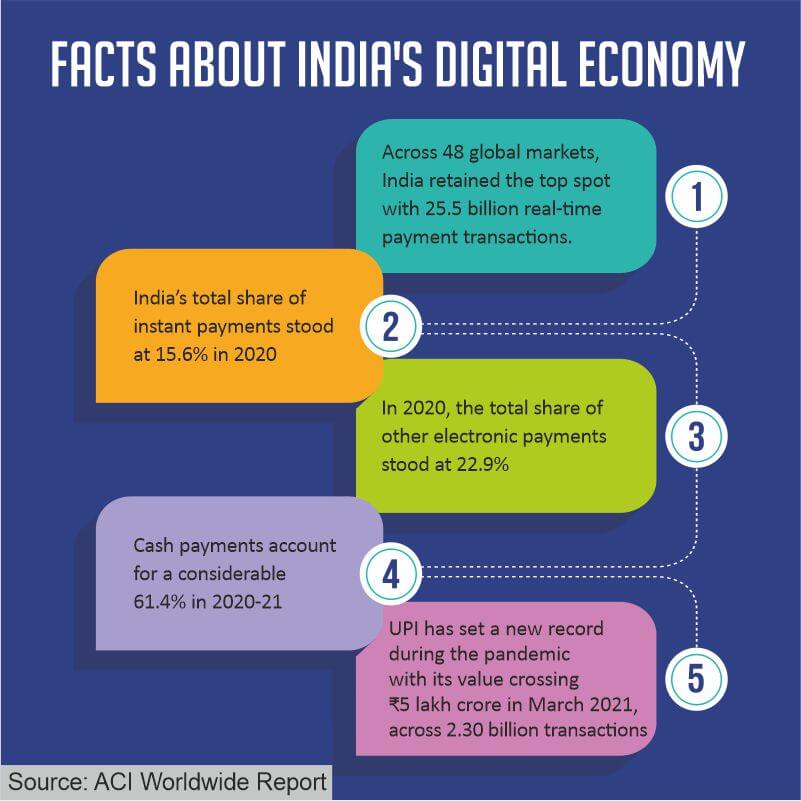

The Google and The Boston Consulting Group Report estimates that non-cash transactions, which constituted about 22% of all consumer payments in 2018, will overtake cash transactions by 2023.

India's digital payments scene saw a huge growth after demonetization, and that springboard effect has carried on the drive throughout the Covid-19 pandemic. The lockdown and social-distancing rules have brought many first-time users to pay online for buying essentials.

These people are those who were earlier not very keen on using digital platforms for payments due to feelings of fear and mistrust. This has been possible due to the coming together of new-age technology such as e-wallets and Unified Payments Interface (UPI), and mobile banking along with cheaper smartphones and data rates. At present, there are more than 100 million active Unified Payments Interface (UPI) users every month in India, as per the Indian government's statistics.

Digital Transactions during COVID-19

Digital and mobile payments, and in particular contactless payments, are important not just from an efficiency point of view, but also to mitigate risk against COVID-19. It provides a great opportunity to help oneself and the ecosystem as well. According to a survey of 42,000 respondents by consultancy firm Local Circles, buying essentials and mobile recharges are top use cases for digital payments and Paytm and Google Pay are among the top digital payment apps being used by consumers.

Digital payment volume declines are seen in airlines, tourism, hospitality, hotels, entertainment, e-commerce (non-essentials), and restaurants, among other sectors. However, there are also a few areas that are seeing an uptick in digital payments by way of increased adoption during the lockdown. These include online grocery stores, online pharmacies, OTT players (telecom and media), EdTechs, online gaming, recharges, and utility/bill payments. Digital payment volumes are also receiving a boost through the Government, which has pledged monetary assistance to the poor via direct transfers to bank accounts.

Crowdfunding for COVID relief

Raising funds through crowdfunding is becoming the easiest and the most efficient way for non-charitable organizations, especially during the COVID-19 pandemic. By providing bank transfer details or payment options through cashless methods, the common public who want to donate and support the cause can easily contribute digitally.

Ketto, an Indian crowdfunding platform, raised over Rs 115 crore through its campaigns related to Covid-19 and registered a 4X growth during the lockdown. Impact Guru, another such platform, saw donations double per minute post-COVID averaging 2.5 donations per minute now.

Through Ketto, Child Help Foundation raised funds for providing relief and support to families and individuals who were hit hard by the COVID-19 pandemic. Our campaign “Breathe India” aims to help those individuals who are losing their lives due to the lack of oxygen cylinders and concentrators in the country. Child Help Foundation aims at facilitating the necessary medical consumables and medical equipment to save lives.

What does the future hold for E-payments?

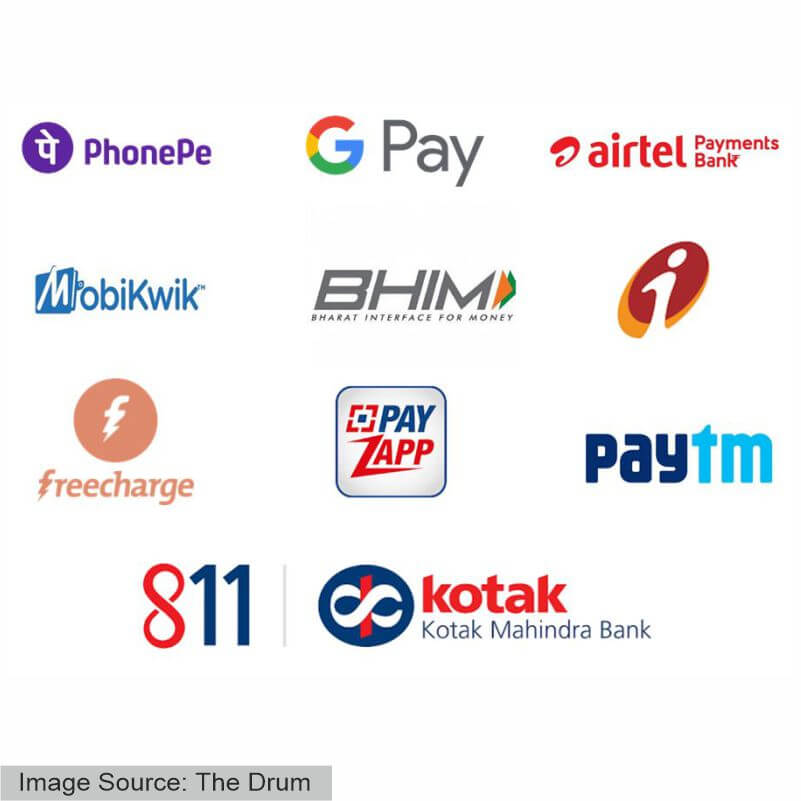

India’s digital economy is expanding with the growth of different payment channels. The government has contributed to the growth of Fintech companies by redefining the services through the introduction of strategies like UPI, IMPS, e-KYC, and Aadhar as authentication methods. Private fintech startups like PhonePe, PayTM, and Razorpay have revolutionized the digital payment market in India.

According to data by the National Payment Corporation of India (NCPI), PhonePe and GooglePay dominate the digital payment sector in 2021. With the growing digital consumer crowd, consumer-friendly e-Wallets play a pivotal role in providing accessible digital transaction facilities through smartphones to urban and rural populations. The benefits of e-wallets are convenience, pocket-friendly, more security, and low costs. Although many rural populations still lack internet access, India has quite a long journey ahead to attain a cashless economy.

With the increasing pace of digital transformation, all sectors are aiming to promote cashless services which will, in turn, boost the digital payment market in India. The future of digital transactions projects only growth and there is barely any coming back from that. A developing country like India is just utilizing its correct resources to come at par with the other countries that are digitally equipped with advanced technology and resources. India’s manpower is its biggest resource which will help it reach the developmental goal it aims for.

Let us know your thoughts on this topic below. Tell us how was your experience using e-payments for the very first time.